Are you a tax professional looking for a way to better reach your clients? Email marketing is an easy, cost-effective way to get your message out and keep in touch with current and prospective clients. In this blog post, we’ll explore how tax professionals can use email marketing to boost their business.

How to set up email marketing for tax professionals

Once you’ve decided to invest in email marketing for tax professionals, the next step is to set up your accountant marketing ideas. This means deciding how you will collect and store emails, how often you will send emails, and determining the content of your emails.

To get started with setting up email marketing for tax professionals, you should first focus on building your email list of subscribers. You can do this by adding a sign-up form to your website, using social media to promote your list, or offering incentives to encourage people to sign up. Additionally, you can use email marketing platforms like Upscribe to help you easily capture email addresses.

Once you have an email list of subscribers, you can start personalizing your emails and crafting engaging messages. This means using the subscriber’s name in your emails, including visuals and other media to make your emails more appealing, and writing interesting content that will keep readers engaged. You can also create urgency by offering limited-time offers and discounts to encourage people to take action.

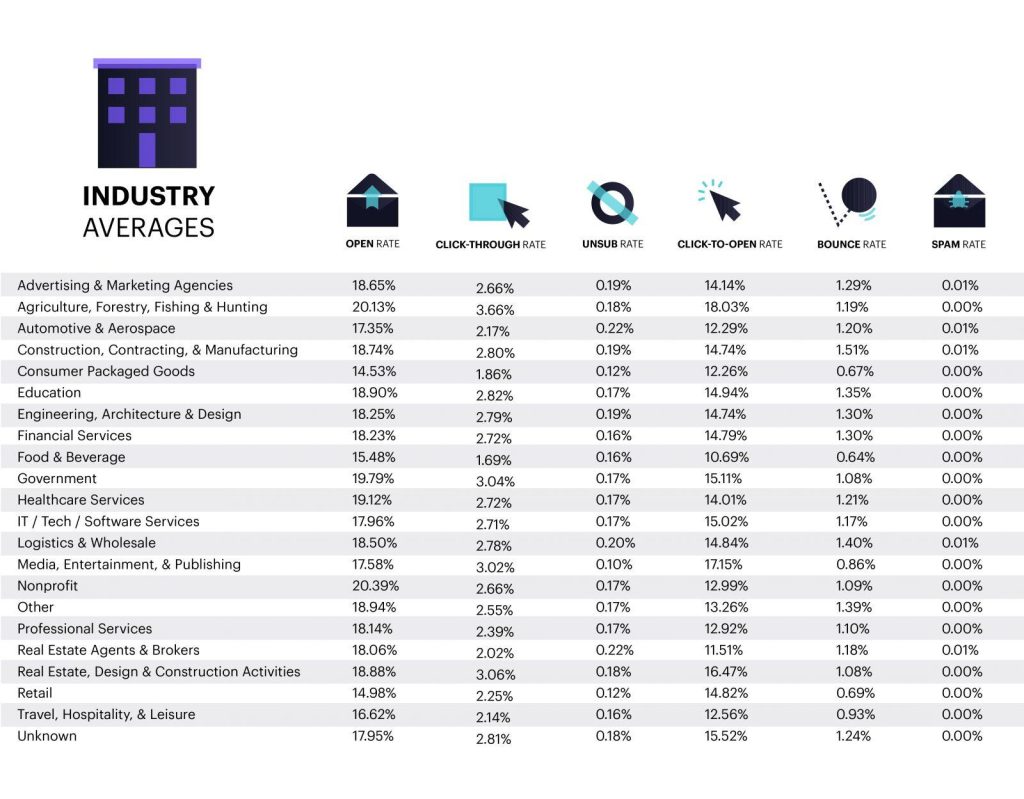

Finally, it’s important to analyze your results to determine what’s working and what’s not. This can be done by tracking metrics such as open rates, click-through rates, and conversion rates. You can then use this data to optimize your emails and improve your email marketing campaigns.

Choosing the right email marketing platform for tax professionals is also essential. With the right platform, you can easily create professional emails, manage your contacts, set up automated emails, and track your results. Subscribe is a great platform that can help you get started with email marketing for tax professionals.

Develop a List of Subscribers

Email marketing can be an effective tool for tax professionals who are looking to reach out to their clients or potential customers. But before you start sending out emails, you need to make sure that you have an email list of subscribers to send them to.

Building your email list of subscribers is the first step of any successful email marketing strategy. This can be done in a variety of ways, such as simply asking people to subscribe to your emails, or offering incentives for people to sign up.

You can also use social media to help build your email list. Encourage followers on platforms such as Facebook and Twitter to sign up for your emails. This can be done by providing a link to a sign-up page or by running a promotion on the platform.

Once you have a list of subscribers, you can start crafting engaging and personalized emails to send out to them. Personalizing your emails can help to increase engagement, as well as create an overall better experience for your subscribers. You can also segment your list into different categories and send out tailored messages to each segment.

By developing a list of subscribers, you can take the next step in creating an effective email marketing tax strategy for your business.

Personalize Your Emails & craft engaging messages

Personalizing emails is a great way to make sure your tax clients feel special. Crafting engaging emails is key to ensuring your content is read and appreciated. Start by including your client’s name in the subject line and body of the email. You should also make sure to use a conversational tone and use language that resonates with your target audience.

You should also keep your emails short, sweet, and to the point. Include visuals and other media such as videos and GIFs to keep your readers interested. Don’t forget to include a call to action in every email to encourage your readers to take the next step. With a personalized and engaging email, you’ll be sure to keep your clients coming back for more!

Include Visuals and Other Media

When it comes to email marketing, you want your content to be eye-catching and engaging. One way to do this is to incorporate visuals and other media into your emails. Visuals can include images, videos, GIFs, and infographics, while other media can include podcasts, webinars, and e-books.

Visuals and other media can help to make your emails stand out. They can also be used to break up long blocks of text and make your emails more visually appealing. Additionally, visuals and other media can help to engage readers and keep them interested in your content. Plus, they may even help to increase conversion rates.

Including visuals and other media in your emails is a great way to make your content more engaging and effective. So, if you want to make your emails stand out and get better results, consider incorporating visuals and other media into your emails.

Create Urgency with Limited Time Offers

Email marketing for tax professionals is a great way to increase your customer base and keep your existing clients engaged. One effective way to accomplish this is by creating a sense of urgency with limited-time offers. By offering discounts or other incentives with a deadline, you can encourage your subscribers to take action quickly.

This is especially effective when you are launching a new product or service or when you have a promotion that you want to drive more sales for. Make sure to include clear instructions and a deadline, so your subscribers know exactly what to do and when. This can help to generate more leads and create a sense of urgency in your email marketing campaigns.

Analyze Your Results

Once you have started sending out emails, it is important to measure the success of your campaigns to ensure that you are achieving your goals. Analyzing your results will help you continually improve your email marketing for tax professionals & some time for tax preparation also. To analyze your results, you will want to look at metrics such as open rates, click-through rates, and conversion rates.

Open rates tell you how many people opened the email, click-through rates tell you how many people clicked on a link in the email, and conversion rates tell you how many people read the email and then click on the link. By looking at the data from these metrics, you can gain valuable insights into what types of emails are most effective for your target audience. This information can then be used to refine your effective marketing campaigns and ensure that you are sending out the most effective emails possible.

Choose the Right Email Marketing Platform

Choosing the right email marketing platform is essential for tax professionals or accounting firms when it comes to setting up their email marketing campaigns. To provide their clients with the best experience, tax professionals should look for a platform that is easy to use, provides powerful features, and offers great customer support.

With the right email marketing platform, tax professionals and accounting firms will be able to create engaging emails, track their results, and effectively reach their target audience. Automated emails can also save time and help tax professionals or accounting firms stay organized as they reach out to their clients. With the right platform, tax professionals can build relationships with their clients, increase customer loyalty, and grow their businesses.

Set Up Automated Emails

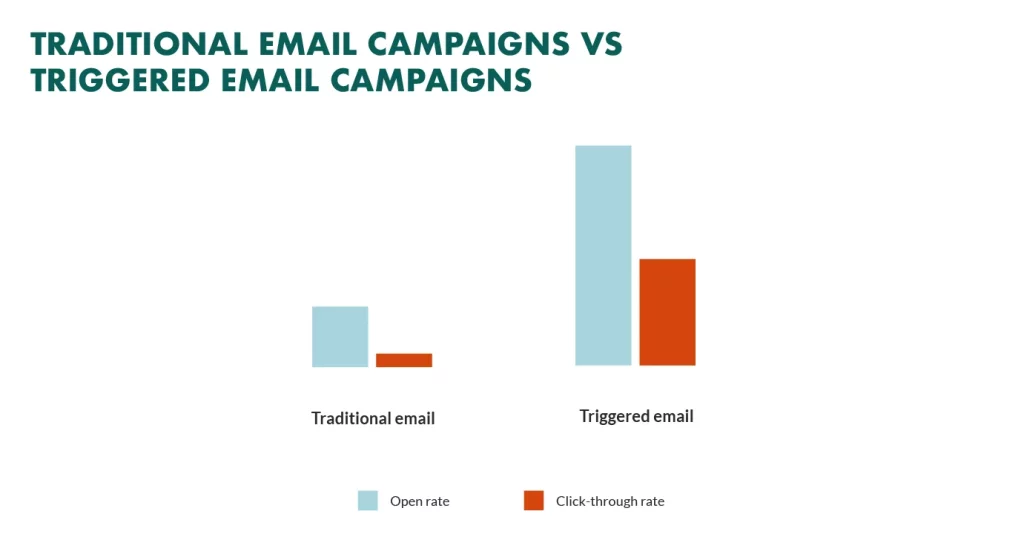

Automated emails are a great tool for tax professionals to keep their clients engaged and informed. They can be used to send timely reminders, discounts and offers, newsletters, tax advice emails, and accounting services. Automated emails can help to save time and money, as well as improve the overall customer experience.

Setting up automated emails is easy and doesn’t require any technical knowledge. All you have to do is decide what type of emails you would like to send, such as tax advice emails, reminder emails, discounts and offers, and customer appreciation emails. Then, you have to decide on the frequency of the emails and set up a schedule for them to be sent out.

Once you’ve set up the emails, you can monitor their performance by looking at the analytics provided by your email marketing platform. This will allow you to track the open rate and click-through rate of the emails, as well as any other metrics that are important to you. By monitoring their performance, you can adjust your effective marketing campaigns and make sure that they are delivering results.

With automated emails, you can make sure that your clients are always informed and up-to-date on your services. This will help you to build relationships with your clients and increase customer loyalty. Automated emails can also be used to generate leads, as they can be used to capture information from prospective clients.

Automated emails are an essential tool for tax professionals, and can help to save time, money, and resources. Setting up automated emails is easy, and can help to improve the customer experience, build relationships with clients, and generate leads.

5 types of email marketing messages for tax professionals

Email marketing for tax professionals is an effective way to reach existing and potential clients. There are a variety of emails you can craft to promote your services, engage your clients, and increase your revenue. Here are five types of email messages you can use to grow your tax business.

Tax Advice Emails

Tax advice emails are one of the most effective email marketing efforts or tactics for tax professionals. They provide value to your existing clients and can help you establish yourself as a trusted source of financial advice. Tax advice emails can include helpful tips, reminders of the upcoming deadline, or advice on how to get the most out of deductions.

Tax advice emails are the perfect way to show off your expertise and stay top-of-mind with clients. You can craft emails with helpful advice about new tax laws or other relevant topics. These emails are also a great way to keep your customers up-to-date with the latest tax code changes and keep them informed.

By providing this valuable content, you will be able to build relationships with your clients and keep them informed of the latest tax information and news. In addition, tax advice emails can help you generate more leads by providing helpful information. People can use this information to make better financial decisions.

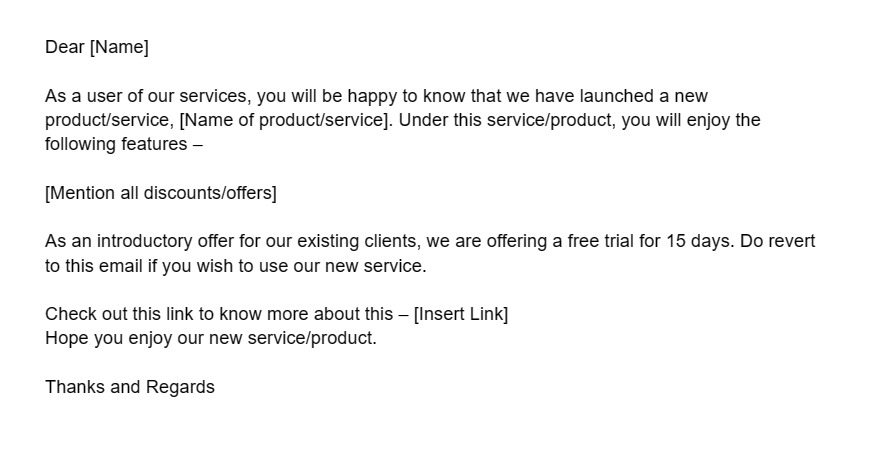

Discounts and Offers Emails

Discounts and offers emails are yet another type of email marketing message that tax professionals can use in their email campaigns. These emails can be used to encourage clients to purchase tax services or products from your firm. By offering discounts, coupons, and other incentives, you can attract more customers and increase your revenues.

Discounts and offers emails are an effective way to generate more revenue for your tax business. You can use these emails to offer discounts on services or exclusive offers to your current and potential clients. These emails will also help you reach a wider audience and boost your profits.

Additionally, you can use these emails to thank existing customers for their loyalty and to encourage them to refer more customers. By offering discounts and other incentives, you can build relationships with existing customers and show that you value their business. And, of course, you can also use these emails to promote new services and products to existing clients.

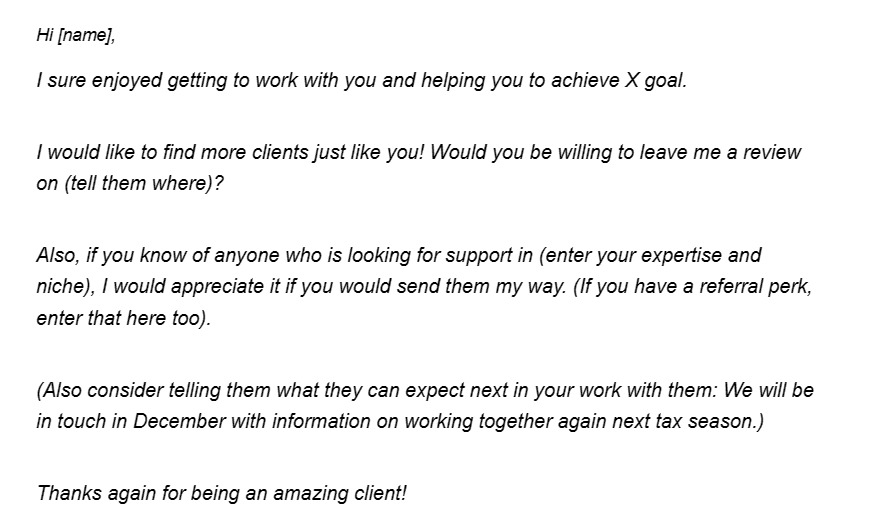

Client Appreciation Emails

Client Appreciation Emails are a great way to show your clients you value their continued support. This kind of email can be used to thank your customers for their loyalty and business, as well as to promote additional products or services.

Client appreciation emails help you build relationships with your clients and show them how much you value their business. Send out emails that thank your clients for their loyalty and remind them of the importance of working with a professional tax preparer.

Whether you’re offering a discount code, a free consultation, or an exclusive offer, be sure to thank your clients and make them feel special. It’s also a great way to make sure they keep coming back to your services. By sending out client appreciation emails, you’ll be able to build relationships with your clients and make sure they feel appreciated.

Newsletters Emails

Tax professionals can benefit greatly from email newsletters. A newsletter is a great way to keep your clients and prospects up-to-date on new tax laws, business news, and other important business information. Newsletters allow you to share informative content in an entertaining format, so your clients and prospects stay engaged with your message.

Newsletters email helps you stay connected with your clients and provide valuable information about what’s going on in the world of taxes. These emails provide an overview of the tax code changes and provide tips and advice on how to save on taxes.

Creating an effective newsletter requires careful planning. You need to decide what topics to cover, and how often you will send your newsletter. You also need to decide what format you will use when sending it, such as HTML or plain text. You should also consider features such as social media sharing buttons, which will help to increase the reach of your message.

Once you have decided on the format and content of your newsletter, you should create an effective call to action. This should encourage your readers to take a specific action, such as downloading a free report or signing up for a free consultation, that is directly related to your tax services.

Finally, make sure you analyze the results of your newsletter. Use tools such as email tracking and segmentation to measure the performance of your campaigns. This will help you to identify areas of improvement and optimize your newsletters for better results.

Reminder Emails

Reminder emails are a great way to stay on top of mind with your clients. They can be used to remind them of important deadlines, such as tax filing or payment due dates. They are also great for informing them of upcoming events, such as seminars or webinars.

Reminder emails are a great way to remind clients of upcoming deadlines and ensure they don’t miss any important dates. You can use these emails to remind clients of upcoming tax filing deadlines.

It’s also important to use reminder emails to promote special offers or discounts. This can help you increase your sales and keep your clients engaged. Make sure you keep your message short, clear, and concise so that it’s easy to understand and can be read quickly. Additionally, make sure you include a call-to-action so that your clients are encouraged to take the desired action.

Conclusion: Set up your email marketing for your tax business today!

Email marketing is an essential tool for tax professionals to build relationships with clients, attract new leads, and ultimately increase their revenue. It’s cost-effective, offers scalability, and provides measurable results. With the right email marketing platform, tax professionals can easily create professional email campaigns and templates in minutes. The key to success is to craft engaging and personalized messages that speak to the needs of your clients. Make sure to include visuals, create urgency with limited-time offers, and analyze your results.

Email marketing can help tax professionals to build trust with clients, gain referrals and boost their bottom line. So, if you’re not already taking advantage of email marketing for your tax business, it’s time to get started!